Cryptocurrency Tulipmania: Bitcoin is a shitcoin

Monday, 10 May 2021.

Have fun staying poor!

Typical Bitcoin maximalist catchphrase (they also call other cryptocurrencies shitcoins while unaware Bitcoin is the worst shitcoin)

The cryptocurrency market is hot. For years, Bitcoin has been going up and up. People worldwide buy and HODL betting on The Rise and Rise of Bitcoin. Etherum and Dogecoin are gaining space in the mainstream too.

HODL is a backronym for "hold on for dear life"

Bitcoin's success is explained by a mix of speculation, "get rich quick" scams, and social problems in today's society. Primarily, the imposition of legal tender, the lack of sound money, and the capture of savings and wealth through inflation and taxation. Why?

While most of the technology employed by cryptocurrencies has value and is profoundly interesting, they are plagued by fraud and design flaws — such as a mining phase that doesn't make sense and waste a lot of energy and resources.

I am a hardcore libertarian and believe in a voluntary society. I want the free market to thrive and the state entirely out of everyone's lives. Yet, here I come and tell you that it's foolish to see Bitcoin (BTC) as either a sound investment or a way for society to free itself from the very institution responsible for most wars and impoverishment of society for ages. In the following sections, I'll cover essential points that form my opinion on this matter.

| ₿itcoin Fact sheet | |

|---|---|

| Speed | Transactions are slow (scalability problems) |

| Privacy | Not much reliable, as transactions are public |

| Inflation | Yes. Flexible ceil of 21 million Bitcoins (or 2.1 quadrillion satoshis) |

| Circulating supply | Short of 90% of its flexible limit as of April, 2021 |

| Original author | Satoshi Nakamoto (pseudonymous) |

| White paper | Bitcoin: A Peer-to-Peer Electronic Cash System |

| Energy used for mining | 0.53% of the world's electricity (114 out of 20.863 TWh) |

| Quantum computing | It won't affect Bitcoin in either a positive or negative manner |

| Website | https://bitcoin.org/ |

Anonymous 17th-century watercolor of the Semper Augustus, famous for being the most expensive tulip sold during the Tulipmania.

Energy hog

Did you know mining rigs for cryptocurrency currently waste about the same amount of electricity the whole population of the Netherlands, United Arab Emirates, or Argentina consumes? Infinitely less valuable than Monopoly cash, Bitcoin requires an insane amount of resources that is dissipated as heat. It doesn’t matter if you’re a tree hugger or a speculation-loving capitalist pig: you must admit this is wasteful. For more information, I highly recommend the Cambridge Bitcoin Electricity Consumption Index website.

A prototype that was taken too far

Cryptography and efficiency aren’t enemies. One algorithm might be fast on a commodity computer and adequate from a security point of view. Why is it that Bitcoin and many other cryptocurrencies use inefficient algorithms, then? In short, it’s to create an artificial scarcity.

Bitcoin is a prototype. The SHA-256 algorithm was used instead of something more efficient like the scrypt used by Litecoin probably because no one had any idea it’d be taken seriously. Given that it was an excellent opportunity for people to enrich themselves from night to day with speculation, it sure took off!

I first learned about Bitcoin at some point <= 2012, and I’ve despised it ever since. You might say now that was a wrong decision, but it was not a dumb one. For sure, I could’ve mined a few coins or bought it, and that would’ve transformed my life, but I put my money where my mouth is.

You don’t create anything meaningful by running random hashing functions non-stop on your computer but a high energy bill, right? It just doesn’t hold water as a sensible use case for computing resources. In any regard, Bitcoin is often told to be a “store of value” that can withstand government intervention, protect people from inflation, and many other lies.

The reason why it is told to be a store of value? It’s not because of the deemed benefits of Bitcoin but because its transaction confirmation is very slow (about 10min), making it impractical for daily usage. Trying to overcome this is the origin of the Lightning Network.

Within the following years, many will lose their fortunes because of cryptocurrency malinvestment. BTC holders will likely be part of them once — for good or worse — another currency takes over the market.

Given that the price of Bitcoin is constructed upon a mindset that it is worth just because it is exchangeable, what stops people moving from it to any other random shitcoin like Dogecoin? Nothing.

So far in 2021 #Bitcoin has lost 97% of its value verses #Dogecoin. The market has spoken. Dogecoin is eating Bitcoin. All the Bitcoin pumpers who claim Bitcoin is better than gold because its price has risen more than gold's must now concede that Dogecoin is better than Bitcoin.

— Peter Schiff (@PeterSchiff) April 16, 2021

Peter Schiff, famous for his predictions about the United States housing bubble, has been exposing the truth about Bitcoin for 12 years.

Economic bubbles

An economic bubble is caused by asset prices being artificially high due to a speculative price surge or misunderstanding of the asset’s real value in the market. Enough time passing, these artificial prices will eventually be deemed out of context with reality, and a crash or bubble burst is inevitable. Whenever such a bubble happens, asset holders will take the toll. That is — unless they’re powerful enough to use politics to make others pay their losses.

In a few years, the average Joe will pay the price when the states bail out pension and hedge funds funds doing cryptocurrency malinvestments today.

Famous economic bubbles include

- Tulipmania, which crashed in February 1637, is recognized as the first economic bubble in history. It was a period during the Dutch Golden Age during which contract prices for bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. At its peak, single tulip bulbs would sell for ten times the annual income of a skilled artisan.

- Wall Street Crash of 1929

- Dotcom bubble leading to 2002’s NASDAQ crash. Even companies that never materialized any profit or revenue would IPO in the stock market.

- United States real estate bubble (and elsewhere) fueled by mortgage loans subsidized by fiat money.

- Unicorn bubble of startups never turning a profit and wasting a lot of seed investment money unwisely without regard to viability or even building a genuine product, to the dismay of Venture Capitalists.

With a stated market cap reaching trillions of US Dollars, the cryptocurrency bubble is about to burst. In the same way, many enriched quickly overnight selling Bitcoins for a lot of money, a lot more will lose their fortunes overnight. If the more traditional sectors of the economy continue embracing Bitcoin as it has been, don’t be surprised when private pension schemes get involved and jeopardize their stakeholders’ funds. If this happens, expect bailouts that will damage the whole economy and — at most – a few funds administrators might go behind bars for a couple of years.

The origins of money

Understanding the origin of money is fundamental to understanding why Bitcoin is a hot potato. Imagine you’re a farmer from over a millennium ago working for subsistence. Eventually, you and your neighbors discover comparative advantage:

You can focus on planting potatoes. Your neighbor can focus on growing beans.

In the end, you both can end up with a better outcome than if you never specialized.

Now, perishables rot, and thanks to economies of scale, you soon enrich and need to buy machinery and household utensils. Besides, suppose that day you wanted to eat lentils. You’d have to go through the trouble of exchanging potatoes for beans, then beans for rice, then rice for lentils (forget the fact that these grains come from all over the world for an instant). How can you simplify this exchange process and take it to the next logical step?

Sure, you can organize a street market where everyone will bring their produce and exchange it with one another! However, many losses still occur as you would pass around commodities and perishables from hand to hand.

Umm… Unless there is a common asset everyone is willing to take as a medium of exchange!

Metals, even more so scarce ones, such as silver and gold, emerge in your community as an answer to this demand.

Carrying around any goods or metal coins has security implications. If you don't need to use the goods or transport them to another location, why not deposit them safely in a vault at your bank? They keep your precious metal in a vault! Now we have the banking industry emerging: a blessing, but also a curse in disguise. While it offers a variety of legit services, it's also a new source for all kinds of scams!

The state and crime syndicates are more than happy to interfere with the financial sector in various ways, such as forcing the adoption of a national currency (and this becomes a widespread practice). Now, banks couldn't emit their private currencies anymore – meaning you lost your freedom of choice.

Previously, banks had a reputation to uphold. If they defrauded their consumers by not redeeming the amount of gold deposited on their accounts, consumers could flee to other players in the market. Not anymore!

In the United States, the Gold Reserve Act forbid the Treasury and financial institutions from redeeming dollar bills for gold in 1934. It was the last remaining nation with a national currency to uphold the gold standard and one of the fundamental reasons, along with free trade, that made the nation prospered so much – not wars!

War has only impoverished common people! Unfortunately, just too many bad history teachers repeating state propaganda as as if it were history fooled generations of kids about that.

Side note: Although a few countries (like many in the Caribbean) don’t have a national currency, no private currency flourished in recent history before Bitcoin appeared in the market, despite efforts like the Liberty Dollar. Also, tolerance for using different currencies exists in specific cases such as close to borders, duty-free concessions, and some travel services (notably in smaller countries).

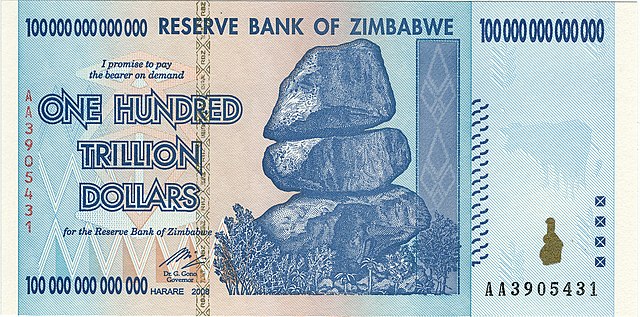

Inflation

Once people were forced to use state-issued money instead of private currency and redeeming gold was forbidden, it was a matter of time for fraud to become a mundane monetary policy. In an authentic show of newspeak, they call it quantitative easing.

The excellent website WTF Happened In 1971? shows how it happened in the history of the United States.

The mainstream media recently adopted a flawed concept of inflation that only exists to justify political interests: a market basket. This doublespeak hides the fact that inflation is the phenomenon of printing money (paper or digital) without a corresponding asset backing it. In other words, fraud.

A currency that lacks backing is called Fiat money. Central bankers use many allegories to support this aberration aided by the systematic bias and conflict of interests common throughout the field of economics. After all, there is an incentive to promote ideas influential people can take advantage of.

Sadly, I see even fellow libertarian friends of mine who know better not to trust central bankers and who are well-versed on the pitfalls of Keynesianism falling for this trap. Unbeknown to them, they were bit by the FED vampire and joined their cult and war against the relevance of the gold standard to the real world. The miracle outlook of getting rich quickly blind people!

Many Bitcoin enthusiasts resort to perverting Carl Menger's theory of subjective value to say that gold is overvalued and Bitcoin is undervalued. They put the currency they HODL as the utmost important currency out there for the sole reason you can trade it while conveniently forgetting anything they might've learned about reality and periodic tables in their lives.

Yes, we value things subjectively, and gold might not have "intrinsic value". However, people do value it because it is useful for something. The only utility of Bitcoin is for its holders to try to convince other people to join their death march.

A dull criticism I've also heard a few times is that the demand for gold is skewed by its use in finances and luxury jewelry – ignoring that gold is a rare metal with essential properties for the industry, medicine, and other fields. I'm sorry, but these allegations indicate a low-quality level of high-school chemistry education.

Even though commonly associated with the Weimar Republic and poor dictatorships like Zimbabwe, inflation also affects current strong state-issued currencies like the US Dollar and Euro.

Scarcity

|

|

One of the alleged benefits of Bitcoin is that its supply is limited to 21 million coins as defined in a constant on its source code. In practice, exploring this vector for an attack is improbable now, but this can happen systematically as a forking strategy or as part of an attack or change of mindset on the Bitcoin community.

One Bitcoin is further divided into 100,000,000 satoshi shitcoins each. In other words, we’ve 21.000.000 × 100,000,000 = 2.100.000.000.000.000 possible shitcoins. So much for scarcity, right? :)

The only way Bitcoin is scarce is that if you’re late to the party, the only way in is buying a ticket from someone else.

In the end, we have a caste system composed of early miners and people who joined the Bitcoin cult at different times. The laggards pay for everyone else’s party with hopes that in the future, it’ll be them profiting from this arrangement. It’s a Ponzi scheme where a minority of whales and big fish form a caste that sustains an illusion just like multilevel marketing scams.

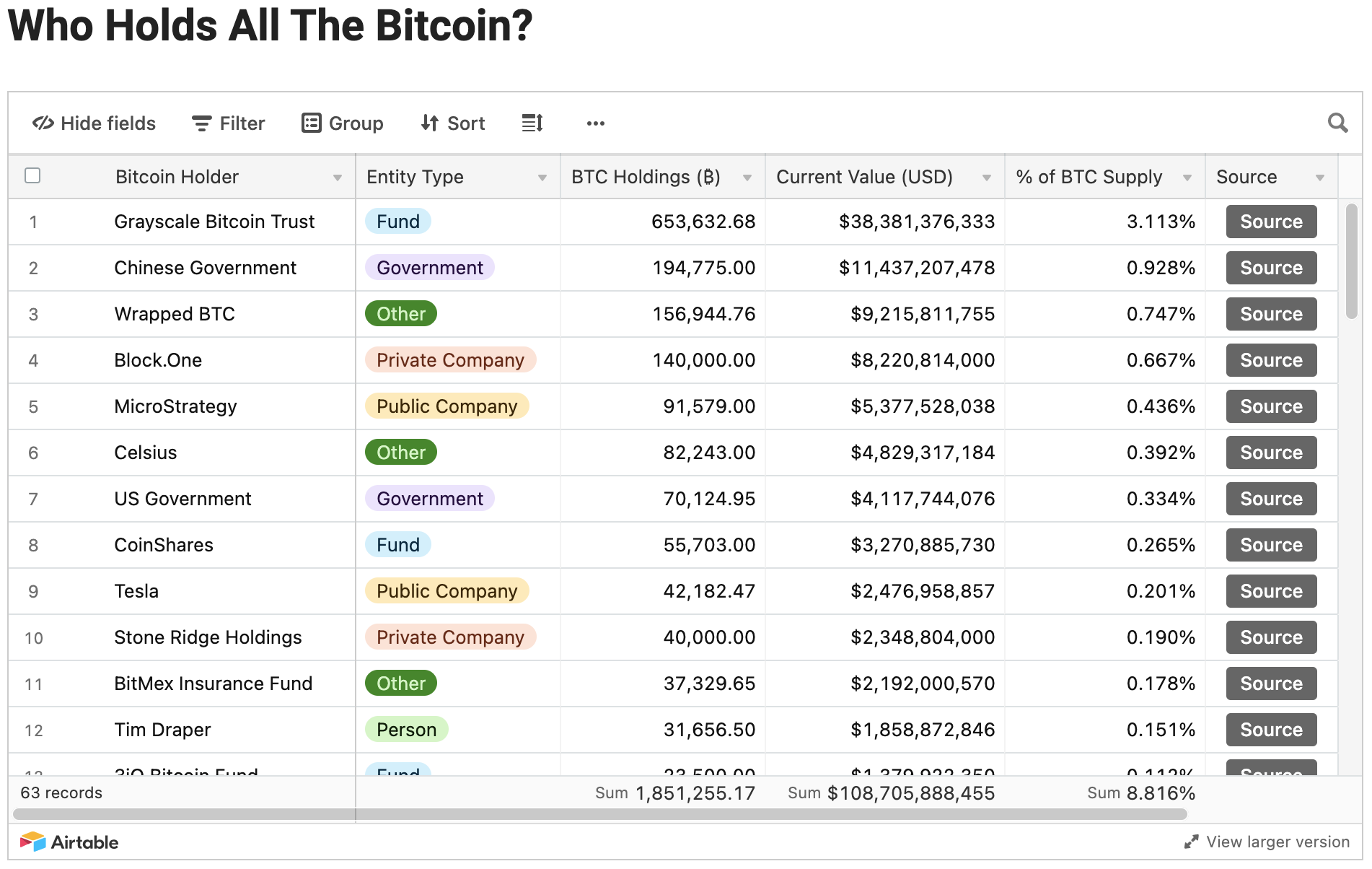

Bitcoin distribution

| Balance | Addresses | Coins (Total) |

|---|---|---|

| [100,000 - 1,000,000) | 4 | 2.98% (2.98%) |

| [10,000 - 100,000) | 82 | 11.26% (14.24%) |

| [1,000 - 10,000) | 2.098 | 27.45% (41.7%) |

| [100 - 1,000) | 14.011 | 21.18% (62.88%) |

| [10 - 100) | 130.861 | 22.76% (85.64%) |

| [1 - 10) | 667.185 | 9.1% (94.74%) |

| [0.1 - 1) | 2.411.689 | 4.04% (98.78%) |

| [0.01 - 0.1) | 5.802.177 | 1% (99.78%) |

| [0.001 - 0.01) | 9.557.929 | 0.2% (99.98%) |

| (0 - 0.001) | 19.661.223 | 0.02% (100%) |

Data from BitInfoCharts during April 2021 shows how a small percentage of people own most Bitcoin coins. The actual concentration is even worse, as people have multiple independent wallet addresses. The moment speculators stop putting money on it, Bitcoin’s market value is going to drop epically. I wonder how bad it will look for companies taking bets on the cryptocurrency market when this happens.

Gold and the gold standard

I’ve also heard about how technology is evolving and will be able to fabricate gold soon. It’s always good to remember what a chemical element is and that nuclear transmutation (fusion or fission) is still hard. The synthesis of precious metals still has a long way to go. A much better criticism of gold is to argue that its use in finances and jewelry artificially inflates its worthiness. Don’t trust Bitcoin alchemists. They’re at least 200 years of scientific knowledge behind.

By the way, if that is the case, what should we say about something as useless as Bitcoin?

Regardless, it’s important to remember that the very concept of the gold standard doesn’t apply necessarily only to gold but to anything genuinely scarce. In theory, you could even back a currency by shares of a company or maple syrup.

Bitcoin maximalists try to divert attention to energy consumption, saying that the traditional banking system uses a lot more energy. I don’t know where they get their data, but they probably take it from the same place where they learned that gold isn’t useful for anything as they probably think that credit card transactions from our daily lives are useless…

Bitcoin mining

Due to the aforementioned poor performance of Bitcoin’s SHA-256 algorithm, Application-specific integrated circuit (ASIC) mining rigs are built specifically for mining it and other Proof-of-work cryptocurrencies. Imagine this is a highly efficient computer in calculating Bitcoin hashes but highly inefficient for any practical workload. The three Rs rule? Reduce, Reuse, and Recycle? The best thing to do with a mining rig once it’s just out of the production line is to dismantle it to pieces.

Antminer, a common rig found on "mining farms".

How does Bitcoin mining work?

In short, to “create” (or mine) a Bitcoin, you run a Proof-of-work algorithm that will increment a nonce and checks if it satisfies some mathematical properties once it’s hashed with a block of transactions. This is a slow and costly process by design, with its difficulty adjusted every 2016 blocks according to the network’s recent performance (about every 14 days). This process is also critical for validating the transactions in the network.

The Proof-of-work algorithm used by Bitcoin is called Hashcash, and was originally created to reduce email spam and denial-of-service attacks (ironically not anymore used by email services because it was costly for legit use cases). Unfortunately, now it is also used to waste energy in exchange of nothing useful for anyone.

You can often pay for access to a mining rig or buy your own to heat up your home, literally. Requiring specialized hardware for hashing these coins or tokens is not advantageous for anyone but the rigs’ owners.

If Bitcoin mining on stock computers is virtually impossible now, even for computers with powerful GPUs, the same is not the case for other cryptocurrencies. Other cryptocurrencies, such as Monero, are mined efficiently using your computer’s CPU or GPU. In fact, there is a shortage of GPU shortage caused by cryptocurrency miners. Nvidia, one of the leading high-end GPU makers, even recently announced they would produce mining-limited GPUs to help gamers – who are having a hard time as GPUs are sold out instantaneously everywhere!

I think my flight sim machine will have to wait :(

Blockchain

The secret sauce of Bitcoin and other cryptocurrencies is the blockchain. You can think of it as a chain of records (or blocks) represented as a Merkle tree. The technology behind it is exciting and has valid real-world applications. You can basically think about it as a form to notarize data and prove that something existed at a given point in time in a reliable and trustworthy way.

Bitcoin’s consensus mechanism for its distributed ledger is built on this idea. You should know that the high energy consumption of Bitcoin is an intrinsic characteristic of its marxist proof-of-work strategy (the computer version of his stupid labor theory of value) and not of blockchains per se. It’d be possible for Bitcoin to use an algorithm that is efficient on regular personal computers. Satoshi Nakamoto just used one that wasn’t on his cryptocurrency prototype.

| Examples of cryptocurrencies | |

|---|---|

| Proof of work | Bitcoin, Bitcoin Cash, Zcash, Ethereum, Ethereum Classic, Dogecoin, Monero |

| Proof of stake | nano, Cardano |

| Proof of space | Chia, Filecoin |

| Stablecoin | Diem (by Facebook), Tether, USD Coin |

Beyond Proof-of-work

There are other consensus mechanisms used for cryptocurrencies such as Proof-of-stake, Proof-of-personhood, Proof-of-authority, and Proof-of-space.

For example, some coins might be distributed via a faucet when using proof-of-stake instead of the typical proof-of-work mining of Bitcoin. That said, even Bitcoin was or is still distributed for free like this, on schemes that might involve solving mundane tasks such as resolving captchas or just wasting your time on a webpage full of ads.

In fact, malware and websites using your browser to mine Bitcoin and other cryptocurrencies eventually became a real problem browser vendors had to deal with.

Another unfortunate form of consensus mechanism that has been gaining traction is proof-of-space, used by Chia and Filecoin. Such a system could theoretically explore storing data for someone else in a productive manner in exchange for coins. Except what happens is pure speculation. This idea only moves wasting resources from the processing units to the storage devices and will likely cause a price surge for storage devices in the upcoming months.

Stablecoins

A stablecoin can be backed by assets such as commodities or pegged to other currencies (crypto or not). For example, the USD Coin (USDC) is backed by the United States Dollar (a shitcoin since the 70s too). Fun fact: Tether falsely claimed to be backed by USD, and then they lawyered up claiming it was not exactly that when its stability was questioned!

Diem is Facebook’s cryptocurrency and was introduced and formerly known by the name Libra. It’s a stablecoin composed of a reserve basket of multiple legal tender shitcoins like the United States Dollar (USD), Euro (EUR), and Pound Sterling (GPD). It’s akin to the International Monetary Fund’s Special drawing rights (XDR) units of account.

The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. So far SDR 204.2 billion (equivalent to about US$293 billion) have been allocated to members, including SDR 182.6 billion allocated in 2009 in the wake of the global financial crisis. The value of the SDR is based on a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

Non-fungible tokens

Imagine you buy a piece of art from a rando in the streets and receive a piece of paper saying that’s yours, and you cannot do anything special with this paper. Welcome to the world of NFTs.

A non-fungible token (NFT) is a digital record that attests "ownership" over a digital asset on a blockchain.

You can think about it as a modern-day autograph or as a collectible.

An author might autograph an item in your name and put this in one of a dozen blockchains.

Now, you can proudly type an URL to show a piece of work GIF or JPEG file and tell everyone what little fortune you paid for it!

Yes, everyone else has the exact same access you do for the piece of work.

After all, the NFT itself is just a digital certificate or database entry and not the asset in question.

Sites such as Rarible, OpenSea, and Crypto.com NFT are selling these collectibles for vast sums of money for those interested in having their name associated with a piece of art in a blockchain. Of course, this grants you no rights whatsoever, and most people benefiting from such arrangements are brokers. Not artists.

| Website | Examples |

|---|---|

| Rarible | Ape Cryptopunk sold for about $54.000 USD |

| OpenSea | See Top Non-Fungible Tokens |

| Crypto.com NFT | See marketplace |

One appealing aspect for artists is that many NFTs allow them to receive a percentage as royalties on future sales. However, just like in poker, the house always wins. The real winners here are not the artists but the blockchain brokers that created a new way to make artists pay them for what they could've otherwise arranged directly. Of course, we cannot deny the merit of the brokers for convincing people to pay for registration on a database as much as they'd be willing to pay for life-size sculptures that they could take home! Anyway, no wonder it's not hard to find ties between modern art and money laundering, right?

Buying and storing Bitcoins

Let’s suppose you decided to buy Bitcoin (because mining is nearly impossible). You’ll probably become a client from one of the cryptocurrency exchanges out there, such as Binance or Coinbase. You might also want to buy them from investment platforms such as Robinhood and eToro.

Depending on who you buy it from and on your preference, you’ll either manage your own wallet or let your broker hold your Bitcoin on their own wallet. There are advantages and pitfalls for both scenarios.

What is a wallet?

A cryptocurrency wallet is a software or hardware device that manages public-key cryptography for encrypting and signing information or cryptocurrency transactions. Hardware wallets provide better protection than software ones through isolation and physical layers of protection.

If you’re not tech-savvy, you probably don’t want the burden to manage your own wallet. If you are, the page Choose your Bitcoin wallet on Bitcoin.org does a great job explaining your options.

In short, if you use a third-party wallet to hold your Bitcoins, it’ll cost you money, and you’re going to be trusting someone else to keep your tokens safe. And there have been plenty of fraud and notable thefts due to hacking and pure incompetence!

Backup

The average computer user doesn’t back up their data, much less safely and reliably. It’s pretty rare to find someone who does backup their computer and validates if their backup can be fully recoverable — no wonder a man wants to dig a landfill to recover his lost wallet with 7500 Bitcoins.

Sophisticated attack vectors, social engineering, and the advent of ransomware also complicate backup strategy. You’ve to handle off-site copies, rotations, encryption, verification (restore), syncing, and worry about physical security, natural disasters, and fire. To do all this on your own is hard. There isn’t a straightforward solution out there for end-users.

$250 Millions gone overnight

Read Vanity Fair’s story Ponzi Schemes, Private Yachts, and a Missing $250 Million in Crypto: The Strange Tale of Quadriga about the Quadriga Fintech Solutions’s bankruptcy. About 250 million Dollars in cryptocurrencies vanished overnight after Gerald William Cotten, the CEO and founder of the Canadian company, unexpectedly passed away, purportedly without leaving a password behind. Or maybe there is more to it!

Quadriga’s case is no exception. Throughout the cryptocurrency market, you’ll see similar stories. For example, in Japan, Tokyo’s Mt. Gox applied for bankruptcy in 2014 after having 850,000 Bitcoins stolen. In 2019, it was time for Binance to have 7,000 Bitcoins stolen through social engineering.

What is cryptocurrency really good for

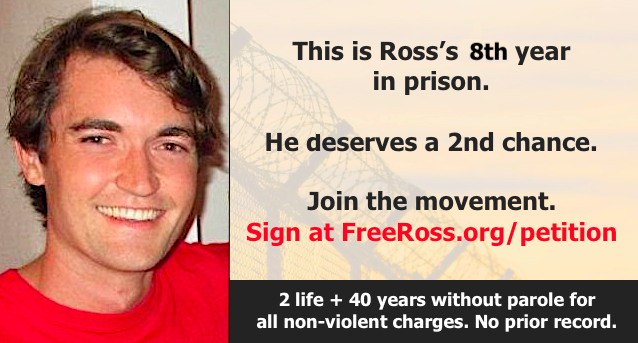

Indeed, blackmailers and ransomware makers might extort people easier with cryptocurrency – just like stalkers can stalk people easier thanks to the Internet! Before you think nothing good can come out of the idea of cryptocurrency though, let me show you a good solid example of Bitcoin helping people evade illegitimate state intervention.

Even though Bitcoin transactions are public and traceable, it’s still possible to use

money launderingmixing services (cryptocurrency tumbler) to make transactions less identifiable.

Silk Road was an online marketplace accessible as a hidden Tor service. It was created by Ross Ulbricht and was best known as a platform for selling illegal drugs. Silk Road Reduced Violence in the Drug Trade. It made the streets safer by providing a safer alternative to get access to drugs in a virtual environment free of violence until its creator was unjustly ambushed and sent to jail. For more information, you might be interested in reading the following studies:

- Not an ‘Ebay for Drugs’: The Cryptomarket ‘Silk Road’ as a Paradigm Shifting Criminal Innovation (Judith Aldrige, University of Manchester; David Décary-Hétu, University of Lausanne).

- Traveling the Silk Road: A measurement analysis of a large anonymous online marketplace (Nicolas Christin, Carnegie Mellon University)

Please, be smart and don’t use drugs!

Closing remarks

People furiously defend Bitcoin’s dominance for a variety of reasons:

- Some believe it’s the emerging global currency of choice.

- Others want it to prevail as a way to reduce the power of the state — and I really wished this made sense, but it doesn’t.

- Others want to have a global currency that facilitates trade.

- Many were just early adopters and understandably want it to succeed!

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

What they miss is that this is a ticking bomb. It doesn’t matter if household names are buying it. It doesn’t matter if the Chinese government is mining it. What really matters is people’s perception of value, and Bitcoin is based on silly and weak assumptions easy to destroy. In the upcoming years, we should see Dogecoin surpassing Bitcoin.

ur welcome pic.twitter.com/e2KF57KLxb

— Elon Musk (@elonmusk) February 4, 2021

All it takes is for an influential personality to say something silly to see cryptocurrency’s value drift wildly. At some point, the market will wake up to reality and understand there is a huge mistake going on.

The Keynesian party of state-issued inflationary currency might be over within the following decades. If I had to make a bet, I’d say stock from publically traded companies might be the base asset for the upcoming currencies.

Another currency could be based on human work. For example, people might emit coins in exchange for a promise to work for a given number of hours. As silly as it might sound, it’s still infinitely better than wasting energy with anything proof-of-work! In case of fraud, you still end up with a currency with the same value as Bitcoin: none.

Bitcoin is just the Nigerian Prince of the XXI century. Everyone cherishes it, but it’s just a useless natural resources hog. Once enough resources are depleted, people will wake up to reality, and, hopefully, we’re going to see solutions emerging that will take over the place of popular shitcoins like the United States Dollar (USD), Euro (EUR), and Pound Sterling (GPD).

Still not convinced? Okay. Be smarter than the average cryptocurrency fanboy. Become a Nigerian Prince yourself! Create your own shitcoin! Why use someone else’s blockchain when you might become the Prince of your castle? All you need to succeed is to be good at marketing to convince people to give you money for no good reason, your highness! Bitcoin maximalists try to ridicularize other cryptocurrency adopters by saying only Bitcoin is the real deal. Don’t believe them. They’re just defending their own vested interests. And before anyone asks: yes, Bitcoin is inferior to Dogecoin in all senses.

If you haven’t invested in Bitcoin yet, congratulations! Don’t let the fear of missing out win you over!

If you are invested, I hope you disinvest before it’s too late!

While I say this, a lot of people will get COVID-19 stimulus money to buy Bitcoin.

Oh, before I go… Friday’s The Economist cover? Govcoins: The digital currencies that will transform finance. Yeah, they are talking about state-issued shitcoins that…

“would be guaranteed by the full faith of the state”.

¯\_(ツ)_/¯

Cryptocurrency Tulipmania: Bitcoin is a hustle https://t.co/5kWeASTNOl#Bitcoin #cryptocurrency

— Henrique Vicente (@henriquev) May 10, 2021

I hope you enjoyed my article. If you hated it, thanks for reaching here anyways! I wanted to talk more about interesting things such as smart contracts (and how their concepts have been used and abused) and go a little deeper explaining what a blockchain is, but this article is already too long!

If you click and buy any of these from Amazon after visiting the links above, I might get a commission from their Affiliate program.

Tweet